Last week, we hosted the SixThirty CEO Summit 2025 — our annual gathering of LPs, portfolio company founders, and ecosystem partners.

Each year, this event gives us the opportunity to step back, connect, and sharpen our collective perspective on where our industry is headed. It is one of our favorite moments of the year because of the insights, relationships, and collaborations it sparks.

This year’s agenda was designed to highlight not only the current state of the market but also the frameworks and mindsets that will shape our future. From discussions on the Compound Startup, to updates on the venture capital market, to conversations on grit and determination in entrepreneurship, the digital assets ecosystem, and even societal challenges around health and wealth, the sessions reflected the breadth and depth of challenges and opportunities facing founders and incumbents alike.

From these conversations, five big takeaways stood out:

1. The Power of Problem Selection

Startups often begin with a sharp point solution aimed at solving one specific problem. And, in many ways, a Founder’s success hinges on their ability to identify and select the right problem out of the gate.

But, the margin of error for a point solution is very low. Think of a point solution through the lens of cooking… point solutions require a baker’s precision – all of the right ingredients, measured accurately, mixed to perfection, and baked at the right temperature. Not a lot of room to adapt on the fly. Add too much sugar? Not enough milk? Bake at too high a temperature? All of those, as they say, are recipes for failure. The same can be said for a point solution where success is predicated on precisely delivering the perfect feature set, to solve the perfect use case, for the ideal customer persona…and to do so quickly as follow on capital won’t be waiting unless market traction is materialized.

True value, both for the business and the market, emerges when those initial solutions evolve into platforms. Platforms accelerate adoption by increasing the surface area for problem-solving, enabling startups to more deeply and holistically solve for the business challenges their customers face. Back to our cooking example – think of platforms as a Ceasar Salad…outside of the lettuce, you can essentially add/change/omit almost any ingredient and still have a pretty tasty lunch. Platforms give founders the ability to package together interoperable solutions, thereby more deeply serving their customers without having individual, best-in-breed solutions.

This theme was reinforced during our Compound Startup discussion with David Karandish, CEO of Capacity. He shared his personal experience along with the frameworks and strategies that have led Capacity to acquire thirteen companies (including one of our own) as they broaden the aperture of the business problems and industries they can support and the biggest constraint to achieving scale is time.

David unpacked the idea that Founders, by enlarge, fall into three buckets:

- Problem Explainers – those who excel at deeply explaining the problem to be solved, both internally and externally, and develop the strategy on to attack it

- Problem Solvers – those who tear into a problem like a dog with a bone – they are typically more technically oriented and dive right into the building of the solution

- Problem Selectors – those who think deeply about all of the problems that can be solved and carefully select where they will focus their energy on which problem to solve, and in which order

One could argue that being an effective Problem Selector is the most important differentiator when starting a business. Of course, founders (and collectively their founding teams) need to be able to articulate the problem, build the solution, and bring it to market, but it all starts with choosing the right problem to solve.

From there, the compound startup approach enables founders to move beyond the original problem selection / point solution to create platforms that solve for the whole problem, rather than just one part of it, bringing clarity to decisions on what to build, buy, or who to partner with. By accurately selecting the right problem from the start and compounding from the edges or nodes to create a more holistic solution, a founder’s probability of success significantly increases.

2. Technology Isn’t the Challenge — Change Is

Again and again throughout the summit, one truth came through: the biggest barrier isn’t the technology itself, but the change required to adopt it. Change comes from building trust, aligning on the real business challenges, and moving forward with conviction. This is where the CEO Summit plays a unique role — giving attendees a forum to learn from each other, share candid perspectives, and build the trust needed to power meaningful transformation.

Jackie Hyland’s VC Market Update reinforced this point, showing how capital allocators are placing fewer, higher-conviction bets. Both investors and startups are aligning around disciplined focus, recognizing that success requires not just innovative technology but the ability to manage change and execute against the most important priorities.

3. When it comes to AI – Focus on the Core Things, Safely

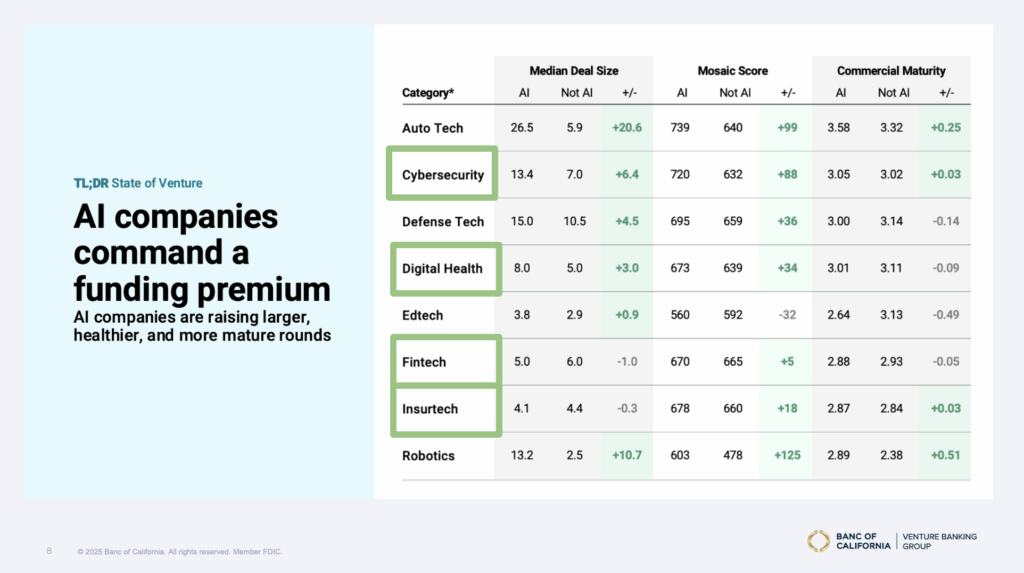

For those who were in the room for Jackie Hyland’s presentation, one slide that stood out was the premium (or relative lack there of) AI-centric Fintech and Insurtech players commanded in the marketplace relative to their non-AI brethren. After unpacking the data, however, there’s one logical explanation for why these firms aren’t commanding massive premiums relative to other industries – their customers aren’t demanding that they bring AI solutions to them.

Incumbent financial institutions are typically laggards for new technology adoption. Why? Their need for proven solutions that don’t introduce security and compliance risk regularly tip the scales towards a “wait and see” approach to innovation. This leads many Fintechs and Insurtechs who have achieved scale to deprioritize AI as, put simply, their clients just aren’t ready to adopt the most impactful use cases. Instead, they are experimenting with lower value, less risky plays like the development of marketing copy and AI-based notetakers.

However, an alternative theme emerged during our AI Breakout session – “Don’t focus on safe things. Focus on core things — safely.” For AI to achieve its lofty promise, firms must move beyond experiments at the edges and rethink how intelligence can be embedded into the very core of what they do. That shift requires courage, strong leadership, and a willingness to reimagine processes at scale.

Business leaders are narrowing their list of priorities to only the most critical opportunities. There’s no patience for distractions or initiatives that fall outside the core. At the same time, there is a healthy urgency: founders and corporate leaders alike are working to move quickly on the right long-term bets, knowing that the pace of industry change won’t wait. Success lies in balancing focus with speed.

4. The Ecosystem is the Differentiator

What sets SixThirty apart is not just capital, but the community we convene. Our sponsors, speakers, and partners aren’t passive supporters — they are active co-creators. This year, that collaboration came to life in new ways, such as EY’s breakout session on the future of banking, which proved to be a huge success. Our dinner speakers, often from outside the traditional worlds of finance and VC, continue to inspire and broaden perspectives. Together, our ecosystem strengthens the experience for every founder and investor in the room.

The session on Grit and Determination reminded us that most startups face troubled beginnings, and it is resilience, creativity, and discipline that ultimately carry founders through to inflection points. Thank you Ben, Trevor, and Ravi for sharing your individual stories in such an authentic and impactful way.

Meanwhile, our panel on Digital Assets and Tokenization underscored how the ecosystem itself will determine which players endure. We discussed the infrastructure — legal, technical, and financial — required for tokenized assets and stablecoins to scale, and why institutional-grade rails matter. This discussion prompted a question…will the traditional bank cores step up the plate and create this infrastructure? Or, will they be displaced by future-proofed alternative platforms that are faster and more adaptable?

Regardless, it’s clear that tokenization is shifting from concept to infrastructure. The consensus: a handful of credible, well-capitalized issuers are most likely to emerge, balancing regulatory acceptance with market demand, and reshaping how capital flows across the industry. Whats still up for debate is who will emerge as the bedrock infrastructure to enable a tozen-based world.

5. The Challenges Ahead Are Large, But Don’t Let That Discourage You

Finally, our Health & Wealth breakout session challenged us to think bigger than firm-level or market-level solutions. Solving issues like the long-term care (LTC) problem may require a policy- or society-level effort, similar to the creation of Social Security — a reminder that the ecosystem we are part of extends well into our personal lives and beyond.

Our final keynote, Dr. Ellen Reed, also spoke about a strategy for solving big problems, and staying the course when the challenges ahead feel daunting: every day focus on one thing you did well. One success. When it’s easy to focus on all of the challenges that remain, finding one success each day rewires our brains to focus on doing each thing that we can control, well.

This message was echoed during our evening dinner keynote, when Ben Hochman unpacked his framework for “survive days vs. attack days” when chasing a dream — a reminder that resilience requires both defensive and offensive postures in equal measure. Attendees told us this struck a chord, as they wrestle with how to stay focused while still pushing forward aggressively in dynamic markets.

As Atul Kamra, our Managing Partner reminds us, when facing complex, long-term challenges, “what you think about most, grows.” Creating daily discipline to focus on being solution oriented (and to deprioritize distractions) creates the compounding momentum needed to transform more days from survive mode to attack mode.

Looking Ahead

The CEO Summit is more than a single day — it’s a marker in our collective journey as an ecosystem. From frameworks like the Compound Startup, to the candid market outlooks, to the gritty stories of resilience, the recognition that change is harder than technology itself, and the societal challenges looming on the horizon, this year’s program was a reflection of both where we are and where we are headed.

Many remarked that the Summit has become a favorite in their calendar, thanks to the quality of conversations and the authenticity of the people in the room. The warm welcome in St. Louis and the level of engagement across the ecosystem underscored the sense of community that powers SixThirty.

With AI moving from experiments to the core and tokenization laying the groundwork for a new financial infrastructure, the conversations this year underscored both the urgency and the opportunity in front of us.

Thank you to everyone who joined us and contributed to such a rich and inspiring event. We’re already looking forward to the progress, breakthroughs, and collaborations we’ll build together between now and next year.