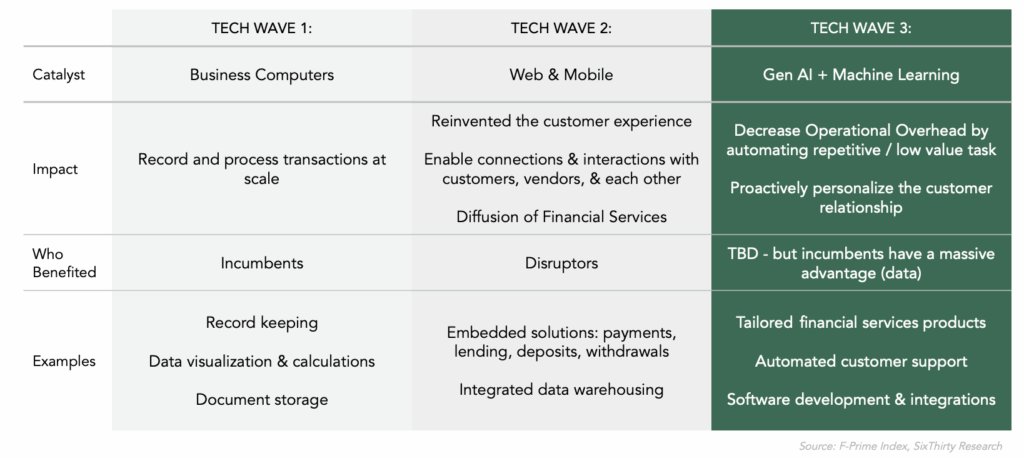

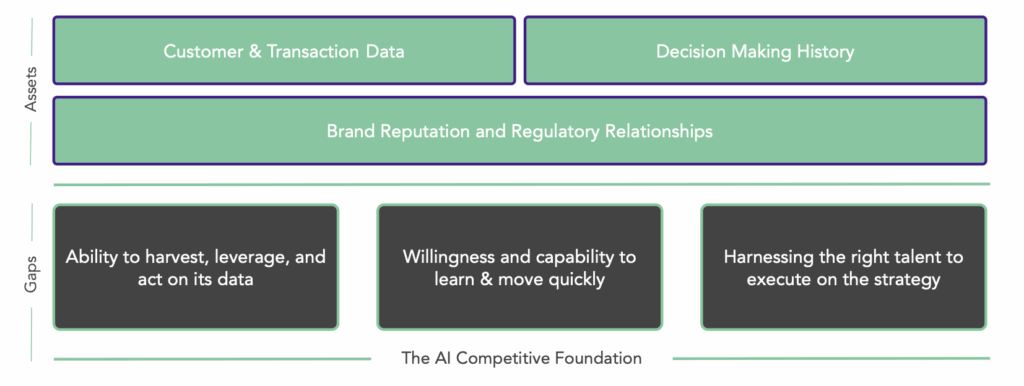

Artificial intelligence is not just another technology cycle—it represents a structural shift in how banks compete. The advent of mobile and cloud technologies diffused access and lowered barriers, giving fintech challengers the upper hand. AI, by contrast, has the opportunity to shift the advantage back to incumbent financial institutions. With deep customer bases, decades of transaction data, and embedded regulatory standing, banks are better positioned than they might, at surface level, appear. The valuation premium that once fueled fintech disruption has already collapsed, and the edge now lies with those who can wield AI at scale.

1. From Disruption to Incumbent Advantage

For the last decade, the story of disruption in banking has been about smaller, faster fintechs taking market share. Mobile technology gave them reach, cloud gave them scale, and customers—especially digital natives—were quick to adopt.

AI, however, flips the narrative. It amplifies the strengths incumbents already have: massive datasets, regulatory credibility, and established trust. Instead of fighting complexity, banks can use AI to make sense of it, delivering personalization and efficiency challengers cannot easily match. If mobile empowered the disruptor, AI could restore advantage to the incumbent.

Key Takeaway: Banks should stop viewing themselves as vulnerable laggards and start leaning into AI as a competitive weapon, recognizing that incumbency is now an asset, not a liability.

2. Productivity Pressure and the Talent Mandate

At the same time, banks face unprecedented pressure to grow loans and deposits in a world where the moat of “complexity” is eroding. Switching between providers has never been easier, and customers increasingly demand seamless, transparent experiences. The industry often repeats the phrase “automate the ordinary and humanize the extraordinary,” but slogans alone won’t meet the challenge. To truly unlock productivity, banks must embed sophisticated AI systems in their core workflows while reimagining the role of their people. This means ripping off the band-aid—leveling up talent, re-skilling teams, and focusing human capital on judgment, creativity, and relationship-building where it matters most.

Key Takeaway: AI is only half the answer; banks must invest just as heavily in their people, ensuring technology and talent evolve together.

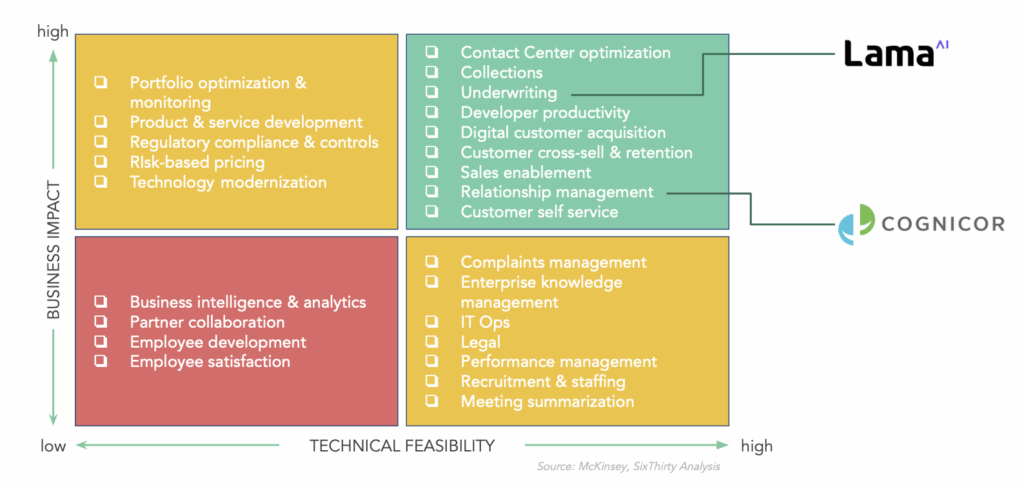

3. Doing Core Things Safely

Too often, AI in banking has been confined to “safe” pilots—drafting marketing copy, summarizing call notes, or automating routine back-office tasks. These are helpful, but not transformative. The real opportunity lies in core domains: credit underwriting, fraud detection, compliance, and liquidity management. These are the beating heart of banking, where AI can deliver durable advantage. But they are also the riskiest areas if mishandled. The banks that lead will be those that step confidently into high-value, high-impact domains, while building the governance, transparency, and accountability needed to do them safely.

Key Takeaway: Focus AI efforts where they matter most—core, high-impact functions—and build the governance to do them safely.

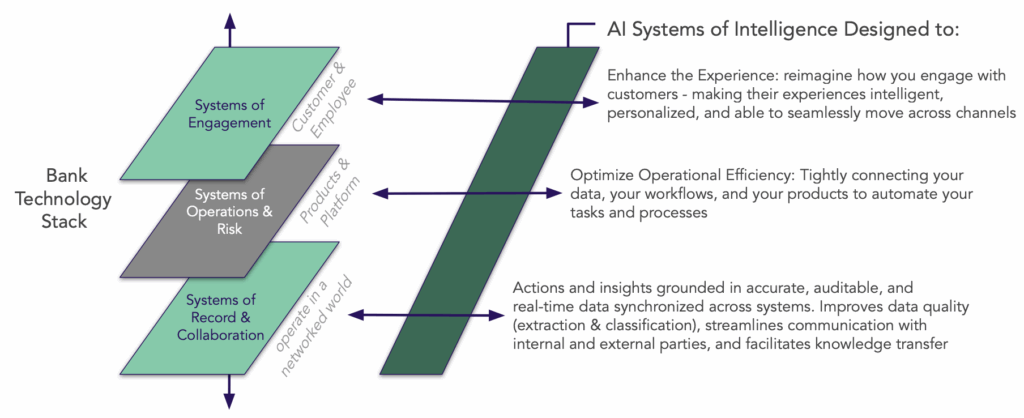

4. Full-Stack Thinking

AI is not a widget to be bolted onto the side of the bank—it must be woven into the institution’s architecture. A true AI bank is built from the ground up, connecting systems of record, systems of intelligence, and systems of engagement. Without clean data, orchestration, and governance, AI efforts will stall at the edges. With them, banks can not only run more efficiently but deliver personalized, intelligent experiences at scale. The move to full-stack thinking separates those who dabble in AI from those who transform with it.

Key Takeaway: Treat AI not as a feature but as an operating model—one that spans every layer of the bank.

5. Harness and Sponsor

Finally, success in AI comes down to two essential conditions: harness and sponsor. Harness is about mobilizing the inputs—unlocking data, cultivating talent, and operating with speed. Sponsor is about leadership. Without clear, visible commitment from the CEO and board, even the best AI initiatives risk being trapped in “pilot purgatory.” The combination of bottom-up capability and top-down mandate is non-negotiable. One without the other is insufficient.

Key Takeaway: Build the muscle from the bottom up, but ensure there’s a top-down mandate—AI success requires both.

Closing: A Defining Moment

AI is not an experiment to observe from the sidelines. It is a strategic inflection point. Banks that move boldly—leveraging incumbent advantages, embedding AI across the stack, tackling core domains with discipline, and driving adoption from the top—will shape the future of the industry. Those that hesitate risk watching the ground shift beneath them.

AI is not the next wave of fintech disruption. It is the opportunity for banks to reclaim the advantage.